Economic challenges and wet weather dampen house building in first quarter, reports NHBC

13 May 2024

Download Q1 review

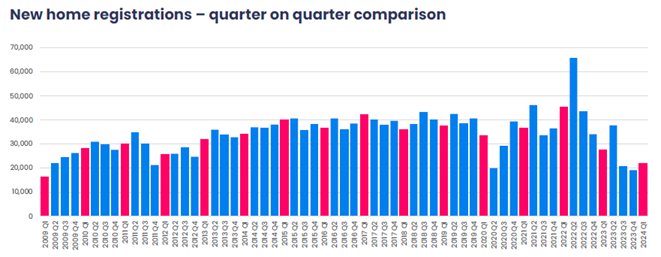

- New home registrations down 20% in Q1 2024 vs. Q1 2023

- New home completions down 13% in Q1 2024 vs. Q1 2023

- Registrations increase month-on-month in Q1

Figures released today by the National House Building Council (NHBC), the UK’s largest provider of new home warranties and insurance, show 21,967 new homes were registered to be built in Q1 2024, down 20% on Q1 2023 (27,619).

26,240 new homes were completed in the same period, 13% down on Q1 2023 (30,071).

Despite the fall - attributed to continued economic challenges, skills shortages and the eighth wettest winter on record - there are tentative signs of growth, with new home registrations increasing month-on-month in the first quarter. 8,320 new homes were registered to be built in March compared to 6,557 in January and 7,090 in February. Q1 2024 registrations were also higher than Q3 and Q4 2023.

Steve Wood, CEO at NHBC comments: “Our Q1 2024 figures reflect prevailing market conditions. Rises in the Bank of England's base rate have driven mortgage rates higher, leading to a drop in new home purchases and a slowdown in house price growth.

“Prolonged wet weather has also hampered house building output in Q1, with the south of England experiencing its wettest February since 1836, according to the Met Office, and many parts of southern England recording well over twice the average rainfall.

“House builders are cautiously optimistic and it is encouraging to see signs of growth, with a month-on-month increase in registrations since January. This is despite a cumbersome planning system that continues to impede output and a national skills gap that means almost 225,000 extra workers will be required to meet expected UK construction demand by 2027.”

Across the UK, 9 of 12 regions saw a fall in registrations compared to Q1 2023, with the biggest drops in East Midlands (-43%), Wales (-43%) and North West and Merseyside (-41%). Registrations were up in London (+2%), Scotland (+4%) and NI and IOM (+23%).

There were 13,633 private sector registrations in Q1 2024, down 21% on Q1 2023 (17,339). Although there was some refocusing of major house builders’ output to help address the demand for affordable homes, the rental and affordable sector also saw a decline, with 8,334 registrations in Q1 2024, down 19% on Q1 2023 (10,280).

In terms of house types, there were declines of 43% in bungalows, 26% in terraced properties and 24% in detached homes. Apartment registrations saw the lowest fall (-12%) due to the relative strength of the rental and affordable sector.

Steve Wood, CEO at NHBC adds: “Build volumes are anticipated to rise in the second half of the year as economic conditions begin to improve and consumer confidence starts to recover. Any new home-buyer incentives ahead of the general election would also have a positive impact on house-building activity.

“We are seeing early signs of growth returning to the private sector, and affordable house building is holding up well, but skills and planning challenges must be addressed to truly accelerate market recovery.”

Get more NHBC news

Read our latest press releases, industry news, articles and house-builder statistics news.